Trading Update

Last week’s GDP data release confirmed the Australian economy is barely growing with growth slowing to 0.1% for the March quarter and down to 1.1% on an annualised rate.

The previous rate hikes implemented by the RBA now have the economy running at the slowest pace since the early 1990’s excluding the Covid pandemic.

Whilst a soft landing is still on the cards it will require the RBA to start cutting rates sooner rather than later in our opinion and our forecast for an initial rate cut to occur later this year remains intact.

On a per capita basis GDP has now fallen for five consecutive quarters and one could argue that were it not for ongoing low unemployment and continuing elevated government spending at both State and Federal levels a negative GDP number could have been a possibility much like many advanced economies overseas have experienced over the last 12 months.

Whilst we do not expect any change to rates at the upcoming RBA meeting next week the June quarter consumer price index due on July 31 will be crucial in determining how soon we are likely to see RBA move towards cutting rates.

Despite the weak economic growth number residential property prices continued to climb and were up nationally by 0.8% in May according to the Core Logic Home Value Index.

ASCF Current Targeted Distribution Rates

ASCF High Yield Fund

| 3 Months | 6 Months | 12 Months | 24 Months |

|---|---|---|---|

| 6.50% | 7.25% | 7.75% | 7.30% |

ASCF Select Income Fund

| 3 Months | 6 Months | 12 Months | 24 Months |

|---|---|---|---|

| 6.25% | 6.75% | 7.25% | 6.75% |

ASCF Premium Capital Fund

| 6 Months | 12 Months | 18 Months | 24 Months |

|---|---|---|---|

| 6.10% | 6.25% | 6.75% | 6.30% |

ASCF Private Fund

| 3 Months | 6 Months | 12 Months | 24 Months |

|---|---|---|---|

| 8.19% | 8.39% | 8.59% | 8.49% |

Monthly Managed Fund Cumulative Growth & Performance

Managed Funds Under Management

as at 31st of May 2024

| May 2024 | |

|---|---|

| ASCF High Yield Fund | $140,857,393.97 |

| ASCF Select Income Fund | $45,598,692.73 |

| ASCF Premium Capital Fund | $22,876,373.53 |

| Combined Funds under Management | $209,332,460.23 |

In May, loan originations and inquiry levels were strong, with $6,961,000.00 in new loan originations settled.

The unit price across all three of our retail funds remains stable at $1.00 per unit.

All monthly distributions have been paid in full for the month of May.

Lending Activity Update

Quarterly Loan Settlements

as at 31st of May 2024

Current Loans by Fund Source

as at 31st of May 2024

| High Yield Fund | Select Income Fund | Premium Capital Fund | |

|---|---|---|---|

| 1st Mortgage Loans | 81.26% | 100% | 100% |

| 2nd Mortgage Loans | 12.55% | 0% | 0% |

| 1st & 2nd Mortgage Loans | 6.19% | 0% | 0% |

| Avg. Weighted LVR | 56.09% | 50.36% | 49.71% |

| Avg. Loan Size | $1,486,644.09 | $924,022.55 | $900,291.67 |

Current Loans Geography

as at 31st of May 2024

Why Invest with ASCF?

At ASCF, we believe that maintaining returns from our pooled mortgage funds requires a combination of informed decision-making, strategic planning, and ongoing market diligence. Here are some factors we believe that will help you understand why we believe we are the best choice for these types of fund investments.

Firstly, it’s essential to understand our fundamentals. Pooled mortgage funds aggregate capital from multiple investors to fund mortgages, thereby reducing individual risk while providing steady returns. However, not all funds are created equal. We encourage you to research our fund’s track record thoroughly as we are very proud of our performance. Look for funds with a history of consistent performance and transparency with financial statements available and details of the underlying investments which show where your money is invested, both clearly available on our website.

Asset strength within our mortgage book is another critical aspect. Ensure the fund is invested in a variety of properties in strong market locations. The average loan to value ratio (LVR) across the assets is available to ensure a healthy margin in case of recovery is required. This approach spreads risk and can enhance strong returns. At ASCF, we assess the properties carefully taking into account many factors such as, location, property type, and property condition, conducting an independent valuation where required.

We also look at the clients exit strategy, assessed carefully to ensure it is not only realistic but that the client can achieve it.

Next, consider the expertise of the management team. A skilled, experienced team can significantly impact the fund’s performance and compliance. We are proud of our team’s extensive experience and proven track record in our directors consistently managing our pooled mortgage funds.

Another tip is to be mindful of fees. Some funds may have hidden fees that can reduce your returns. Understanding the fee structure and comparing it with other funds ensures you receive value for your investment. Our targeted returns are net of fees and we don’t charge any application or exit fees.

Finally, keep an eye on market trends. The real estate market can be influenced by various factors, including interest rates, economic conditions, and local market dynamics. Staying informed allows us to make timely decisions and adjust as needed. At ASCF, we provide regular market updates and information to help you stay informed.

Investing in pooled mortgage funds can be a rewarding experience when approached with diligence and strategy. We have consistently achieved our targeted returns since inception. Our team at ASCF is here to guide you every step of the way

An Interesting Transaction

Problem:

A customer approached us in 2022 seeking 2nd mortgage funding to pay out his mortgage arrears with a major Australian Bank and provide additional funding to cosmetically renovate his Principal Place of Residence prior to selling. The customer had fallen behind on his mortgage and was experiencing pressure from the 1st mortgage lender to sell the property. He approached ASCF with the idea that he could add value to the property via minor renovations that he would undertake himself and maximise the sale price.

Solution:

A full valuation undertaken at the time on an “as is” basis came in at $675,000 and ASCF provided a 2nd mortgage loan of $194,000 over 12 months at an interest rate of 18%pa to assist the customer execute his plan. Including the first mortgagee debt, the LVR was confirmed at 70.32%. The customer completed the renovation, albeit with some delays, but managed to have the property listed and sold with the support of an ASCF term extension. The customer recently achieved a sale price of $770,000 and was very appreciative of the support shown by ASCF in achieving his goal.

What ASCF Does Differently:

ASCF recognises that sometimes things do not go to plan, but with open and honest communication from the customer and where the our risk parameters continue to be met, we are prepared to work with our customers to achieve positive outcomes.

Market Update

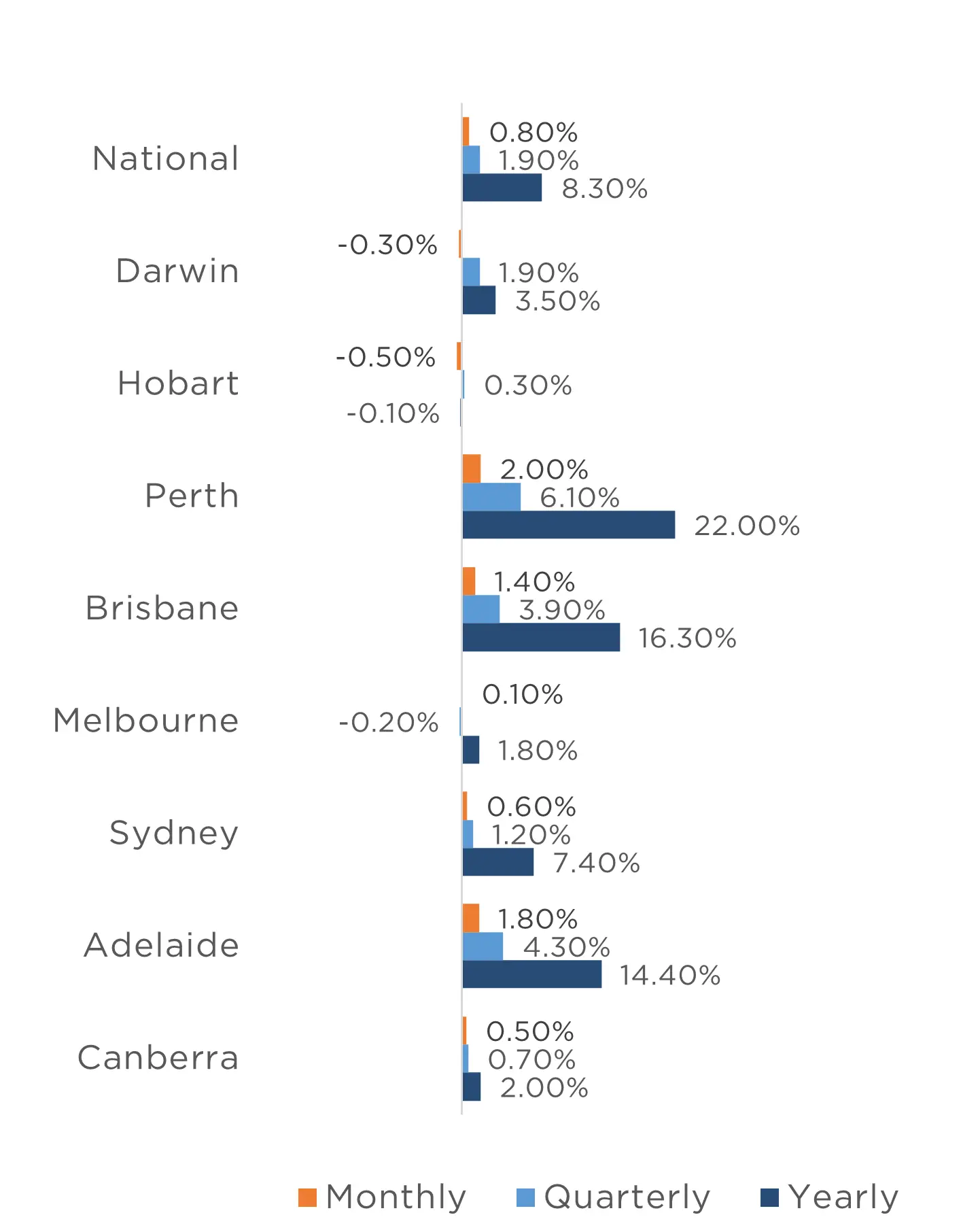

For the 16th consecutive month, property prices across the capital cities have risen, with CoreLogic’s Home Value Index reporting a 0.8% increase for the month of May, the largest monthly gain since October 2023. The regions also continue to experience growth, with a combined 0.6% increase.

Perth continues to be the highest performing market, increasing by a whopping 2% for the month, with Adelaide and Brisbane also recording strong growth of 1.8% and 1.4% respectively. Sydney, Canberra and Melbourne also experienced growth for the month, increasing by 0.6%, 0.5% and 0.1% respectively, whilst only Hobart and Darwin recorded a reduction in dwelling values, of 0.5% and 0.3% respectively.

The RBA is scheduled to next meet on the 18th of June. Whilst we believe a further increase to interest rates is unlikely, the undersupply of new housing and low tenancy vacancy rates should, in our view, ensure property prices remain strong regardless of the RBA decision.

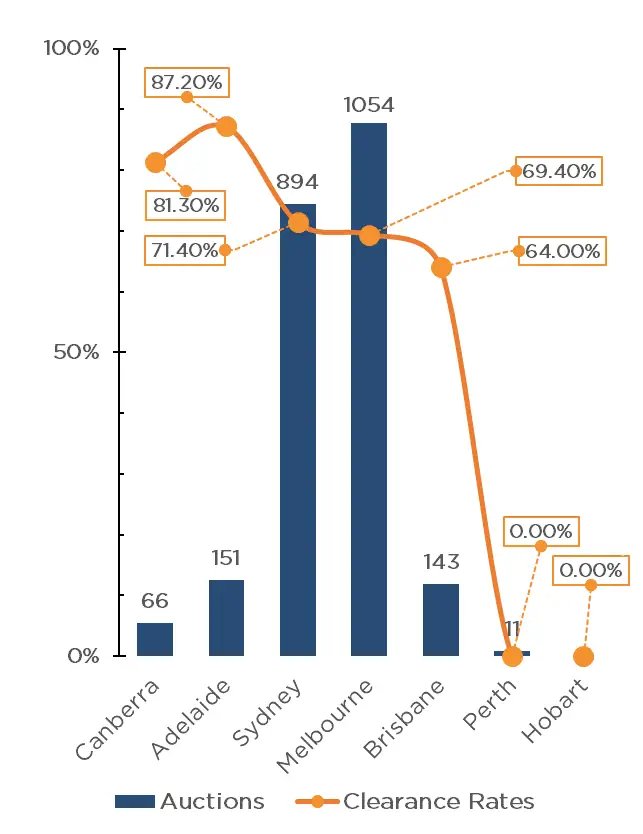

Clearance Rates & Auctions

week of 2nd of June 2024

Property Values

as at 1st of June 2024

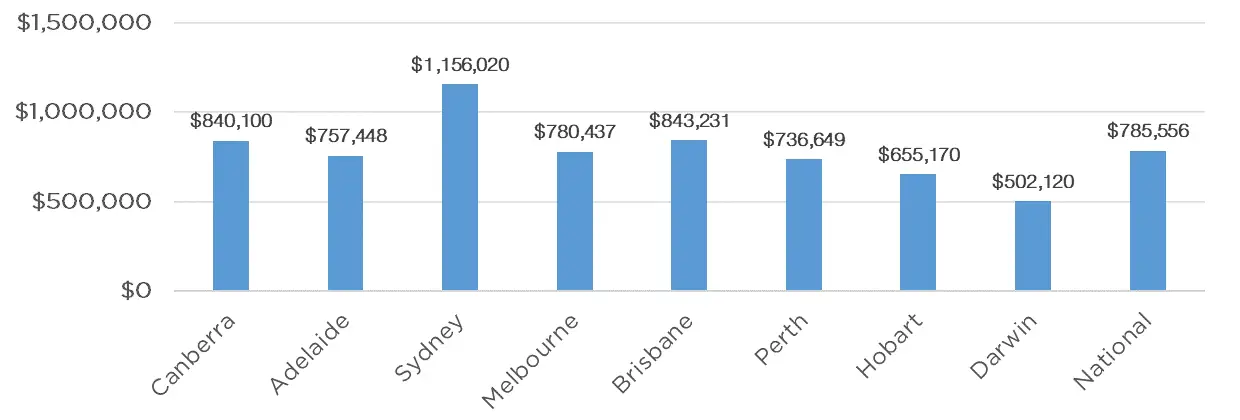

Median Dwelling Values

as at 1st of June 2024

Quick Insights

Investor’s Rush

Loans in the investment property market spiked in April, new home loan commitments to investors jumped 5.60% from March, the fastest rate of gain since November 2021.

Commonwealth Bank senior economist Belinda Allen said,

“There’s no end to price impacts from the lack of supply and strong demand. It’s economics 101″.

Source: Australian Financial Review

Australian Apartments Up Again

There has been a 26% national increase in apartment selling prices, primarily benefiting higher-end developments, this surge alone is driving the rise in new home completions to 28,000 this calendar year. This figure marks the highest in four years, compared to the previous total of 32,000.

However, Urbis director Mark Dawson emphasized that without a corresponding decrease in borrowing or materials costs to make lower-priced unit projects financially feasible, the current spike in completions might taper off in the future.

Source: Australian Financial Review

The post Investor’s Update – May 2024 appeared first on Australian Secure Capital Fund.