Trading Update

Its certainly been an interesting month on the economic front, with the unexpected rise in unemployment for April coming in at 4.1% up 0.2% percentage points from March forcing many economists who previously thought we would not see a rate cut this year to review their forecasts.

ASCF Current Targeted Distribution Rates

ASCF High Yield Fund

| 3 Months | 6 Months | 12 Months | 24 Months |

|---|---|---|---|

| 6.50% | 7.25% | 7.75% | 7.30% |

ASCF Select Income Fund

| 3 Months | 6 Months | 12 Months | 24 Months |

|---|---|---|---|

| 6.25% | 6.75% | 7.25% | 6.75% |

ASCF Premium Capital Fund

| 6 Months | 12 Months | 18 Months | 24 Months |

|---|---|---|---|

| 6.10% | 6.25% | 6.75% | 6.30% |

ASCF Private Fund

| 3 Months | 6 Months | 12 Months | 24 Months |

|---|---|---|---|

| 8.19% | 8.39% | 8.59% | 8.49% |

The RBA left rates on hold at their May board meeting as expected with their statement released post meeting indicating they retained a neutral outlook on the cash rate despite conceding inflation was not falling as quickly as previously expected and will not be within the target range of 2-3 percent until mid to late 2025. This is in contrast to Treasury’s forecasts released with the budget last week which expects that inflation will be at or below 3% by the end of 2024.

Whilst we have no doubt the $300 electricity subsidy and other measures announced in the budget will assist in bringing down inflation and agree that it is likely inflation will be back to 3% by year end, it is the impact of the thirteen RBA rate hikes that are really starting to flow through to the economy that will bring inflation back to target.

As we have previously discussed rate increases always lag between when they are announced and ultimately felt by the economy and this is not generally confirmed until the official data is released, usually months later.

With GDP slowing in each quarter last year to 1.5%, we expect this trend to continue until the RBA starts to cut rates toward the end of 2024. In fact we would not be surprised to see 0.25% reductions at both the September and November or December meetings with a soft landing looking likely where growth remains positive and inflation falls back within the RBA’s desired range.

This month we had an interesting discussion with Forbes regarding the structural under supply of housing across the country and in particular how governments have traditionally failed to implement policies that increase supply rather than stoke demand, click here to read the full article.

Monthly Managed Fund Cumulative Growth & Performance

Managed Funds Under Management

as at 30th of April 2024

| April 2024 | |

|---|---|

| ASCF High Yield Fund | $141,240,068.97 |

| ASCF Select Income Fund | $45,033,692.73 |

| ASCF Premium Capital Fund | $23,591,851.53 |

| Combined Funds under Management | $209,865,613.23 |

In April, loan originations and inquiry levels were strong, with $15,927,500.00 in new loan originations settled.

The unit price across all three of our retail funds remains stable at $1.00 per unit.

All monthly distributions have been paid in full for the month of April.

Lending Activity Update

Quarterly Loan Settlements

as at 30th of April 2024

Current Loans by Fund Source

as at 30th of April 2024

| High Yield Fund | Select Income Fund | Premium Capital Fund | |

|---|---|---|---|

| 1st Mortgage Loans | 79.09% | 100% | 100% |

| 2nd Mortgage Loans | 15.63% | 0% | 0% |

| 1st & 2nd Mortgage Loans | 5.28% | 0% | 0% |

| Avg. Weighted LVR | 55.89% | 52.85% | 48.31% |

| Avg. Loan Size | $1,458,296.06 | $1,010,980.06 | $830,880.00 |

Current Loans Geography

as at 30th of April 2024

Why Invest with ASCF?

This month we would like to welcome Nick Alcock as the newest member to the ASCF investment team and thought we would let him introduce himself in his own words.

With years of brokerage experience under my belt, I stumbled upon ASCF while fielding countless inquiries from both residential and business clients seeking timely access to finance.

One burning question that often arises is about ASCF’s performance over the years and how investors’ funds are safeguarded. Well, I delved into this with the directors and uncovered the well-oiled machine behind ASCF’s success story.

Instead of the traditional peer-to-peer lending model, ASCF takes a different route by pooling investors’ money. This approach not only mitigates risks but also sees them diminish as the funds grow over time.

Impressively, since its inception in 2016, ASCF has consistently delivered on its promise, repaying investors’ investments while achieving monthly interest and hitting targeted rates. It’s a testament to their adept management and strategic foresight.

While I can’t predict the future (no crystal balls here!), ASCF’s stellar track record certainly makes my job easier, especially with current targeted rates of up to 7.75% pa net of fees. Ensuring the security of client funds is a top priority for ASCF, with meticulous management of loans being a cornerstone of their operation.

In today’s market climate, certain types of loans carry higher risks, such as construction loans. ASCF steers clear of these to safeguard investors’ interests.

And here’s the kicker: ASCF’s targeted interest rates remain steadfast throughout the chosen term, regardless of fluctuations in the RBA cash rate. That means even if the cash rate dips, ASCF investors can rest easy knowing their targeted distribution rate remains locked in for the term of the investment.

An Interesting Transaction

Problem:

A new direct broker approached ASCF earlier this month with a very urgent request for finance to help their clients cover the shortfall on the purchase of their new home. The customers were short $70,000 to meet their settlement obligations under the purchase contract which needed to settle next day!

Solution:

The customer explained that they had expected an insurance compensation claim that had been approved would arrive in time for them to settle, however as quite often is the case, the payment was held up.

The ASCF team quickly but carefully undertook a comprehensive due diligence on the property being purchased as well as sought confirmatory documentation on the insurance payment which formed the proposed exit.

Being satisfied with our due diligence outcome, ASCF offered the client a loan of $81,000 representing a 5.80% LVR against the purchase price at an interest rate of 11.95%.

What ASCF Does Differently:

With only 24 hours available, ASCF was able to accurately assess the borrowers’ financial position, assess and mitigate the risks of the transaction and call upon our trusted external partners to pull together to achieve a settlement ready position so that the customer could meet the settlement date on their purchase contract.

Market Update

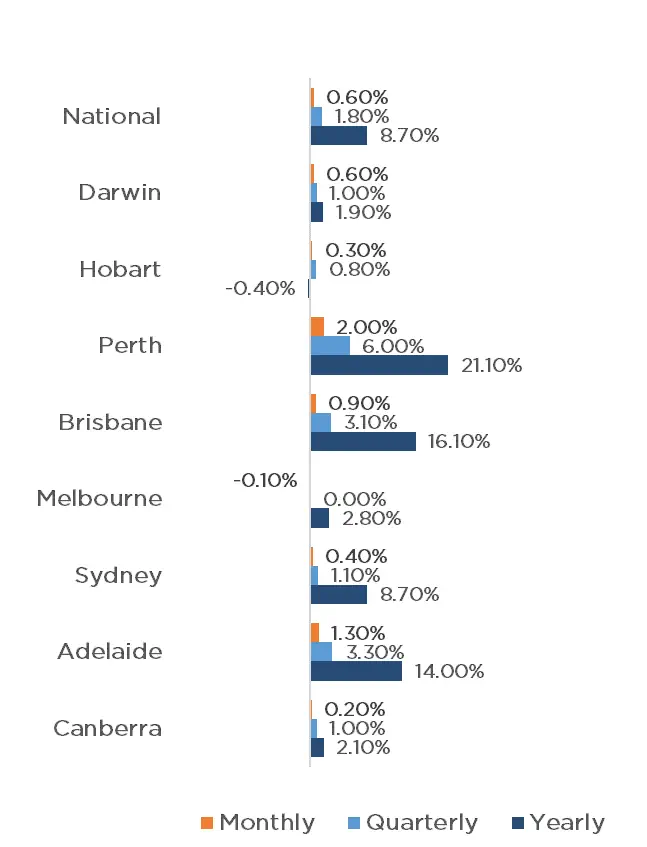

National property values continue to perform strongly, with CoreLogic’s National Home Value Index recording another 0.6% increase in April, the same which was achieved in February and March, resulting in 15 months of continuous monthly growth. Yet again, Perth performed the strongest, increasing by a whopping 2.0% for the month, with Adelaide and Brisbane again achieving the second and third largest growth with 1.3% and 0.9% respectively. Darwin, Sydney, Hobart and Canberra also experienced growth with 0.6%, 0.4%, 0.3% and 0.2% respectively, whilst Melbourne recorded a slight reduction of 0.1%. This raised the quarterly national growth rate to 1.8%, with combined capitals increasing by 1.7% and the combined regions by 2.1%.

The RBA meeting on the 7th of May indicated that we may experience higher interest rates for longer than anticipated, and has not ruled out a further increase in rates, however inflation is beginning to fall, albeit at a slightly slower pace than forecasted. However, with the fundamental undersupply of property, we anticipate the property market to remain strong throughout 2024.

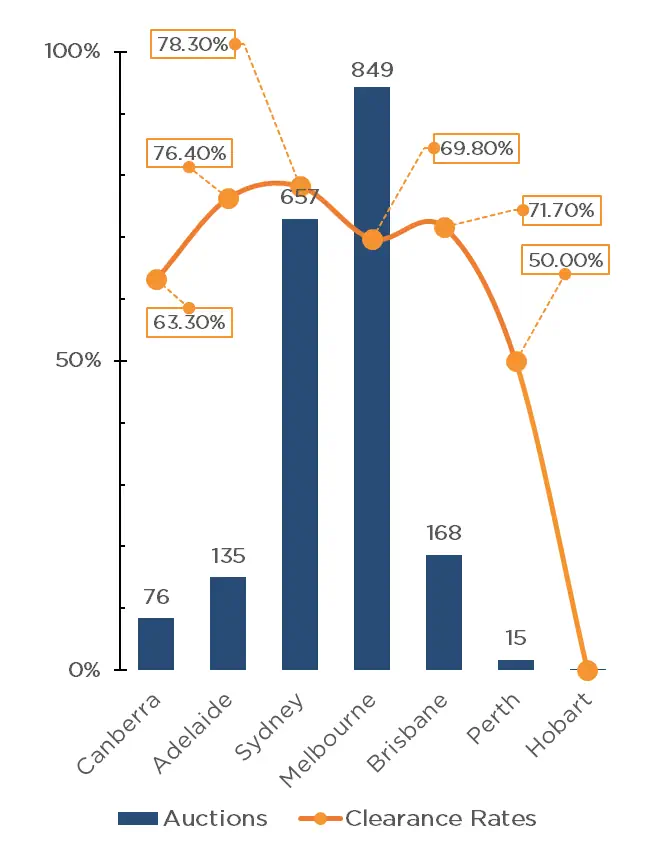

Clearance Rates & Auctions

week of 29th of April 2024

Property Values

as at 1st of May 2024

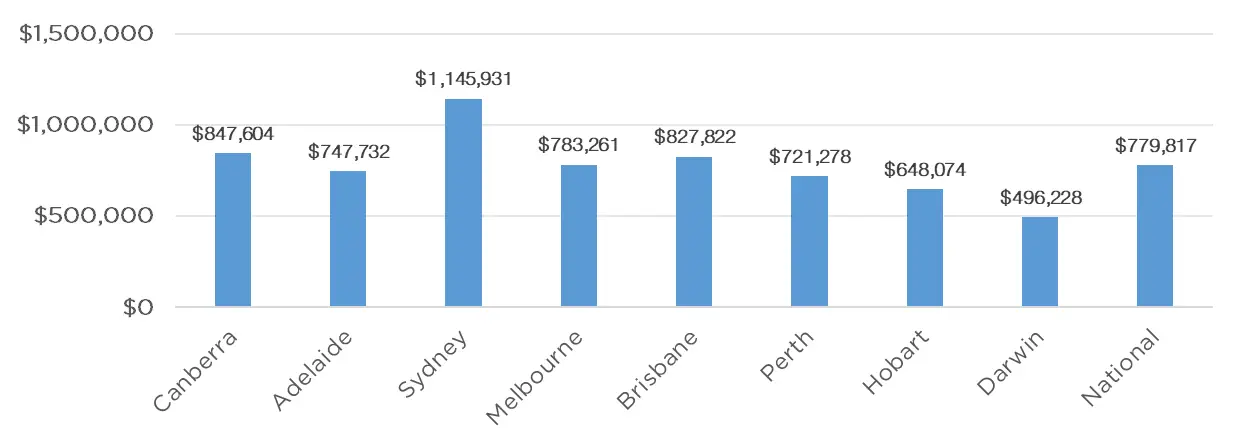

Median Dwelling Values

as at 1st of May 2024

Quick Insights

The Foriegn Housing Fight

In his budget reply speech, Mr Dutton said he would put a two-year ban on foreign investors and temporary residents purchasing homes in Australia if the Opposition won the next federal election.

Ms Tu of “luxury property concierge” firm Black Diamondz, said that, contrary to the perception that foreign buyers were taking housing away from Australians, they injected money into the economy which has helped fund infrastructure and commercial development.

We expect this debate to continue until the next election.

Source: Australian Financial Review

Australia’s Race to Lose

There is no doubt that red tape at all levels of government continues to exacerbate the housing shortfall in Australia, with other comparable countries doing a far better job.

Victoria and NSW are experiencing the longest average development approval wait times at 144 and 114 days respectively, according to new research by the federal Treasury.

Source: Australian Financial Review

The post Investor’s Update – April 2024 appeared first on Australian Secure Capital Fund.