Trading Update

The RBA’s decision to leave rates on hold at their June meeting on Tuesday has provided further confirmation that we are close to the end of the current tightening cycle the RBA embarked on in May last year.

The decision was predominantly predicated on last weeks drop in the inflation data to 5.6% for the year to May – down from 6.8% in April.

ASCF Current Targeted Distribution Rates

ASCF High Yield Fund

| 3 Months | 6 Months | 12 Months | 24 Months |

|---|---|---|---|

| 6.10% | 6.75% | 7.50% | 7.20% |

ASCF Select Income Fund

| 3 Months | 6 Months | 12 Months | 24 Months |

|---|---|---|---|

| 5.85% | 6.25% | 7.00% | 6.65% |

ASCF Premium Capital Fund

| 3 Months | 6 Months | 12 Months | 24 Months |

|---|---|---|---|

| 5.60% | 6.00% | 6.50% | 6.20% |

Whilst inflation is still uncomfortably high for the RBA it is pleasing that they noted in their commentary that the decision “will provide some time to assess the impact of the increase in interest rates to date and the economic outlook.”

Most economists are still predicting at least one more rise with the RBA confirming “further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable timeframe”.

As we have been saying for some time the economic impact from interest rate rises usually takes several months and often longer to filter through the economy and whilst RBA decisions are often data dependent, this data usually lags what is actually happening in the Australian economy which has been impacted by a 4% increase in official rates in a very short period of time of less than 12 months.

With inflation now trending down and the full impact of this year’s rises likely to only be felt over the coming months we believe the RBA has now done enough and is unlikely to further increase rates.

We do expect rates will however remain at these levels for some time and we do not expect inflation to come back to within the RBA’s 2 percent to 3 percent target until late 2024 to early 2025.

The decision to pause should also assist in keeping property prices buoyant however we do believe the stabilisation in prices we have seen over the last few months has been largely supported by a lack of supply and increasing overseas migration along with historically low levels of listings.

Monthly Managed Fund Cumulative Growth & Performance

Note 2: Past performance is not indicative of future performance

Monthly Managed Funds Under Management

Managed Funds Under Management

as at 30th of June 2023

| June 2023 | |

|---|---|

| ASCF High Yield Fund | $120,922,320.56 |

| ASCF Select Income Fund | $45,571,118.73 |

| ASCF Premium Capital Fund | $29,483,353.82 |

| Combined Funds under Management | $195,976,793.11 |

In June, loan originations and inquiry levels remained solid, with $6,902,625.00 in new loan originations settled.

The unit price across all three of our retail funds remains stable at $1.00.

All monthly distributions have been paid in full for the month of June.

Lending Activity Update

Quarterly Loan Settlements

as at 30th of June 2023

Current Loans by Fund Source

as at 30th of June 2023

| High Yield Fund | Select Income Fund | Premium Capital Fund | |

|---|---|---|---|

| 1st Mortgage Loans | 81.21% | 100% | 100% |

| 2nd Mortgage Loans | 14.50% | 0% | 0% |

| 1st & 2nd Mortgage Loans | 4.29% | 0% | 0% |

| Avg. Weighted LVR | 56.23% | 60.55% | 48.31% |

| Avg. Loan Size | $1,377,928.91 | $1,103,544.91 | $742,595.71 |

Current Loans Geography

as at 30th of June 2023

2023 TAX CERTIFICATES NOW AVAILABLE

Tax Certificates for financial year ending 30th June 2023 are now ready for download via our online portal. If you are not registered for the portal, please contact us on 07 3506 3690 and our friendly team will assist you through the registration process.

Make sure you have the mobile phone associated with your account handy, as it will be needed during the registration process.

Need help?

Please contact us:

investor@ascf.com.au

07 3506 3690

Monday – Friday 9am – 5pm AEST

Why Invest with ASCF?

People often ask us what is the difference between a bank term deposit and a mortgage fund and what is the difference between a bank and a non-bank lender?

There are some similarities but there are also many differences.

Obviously, we are in the same financial services industry and both in the business of accepting deposits and on lending that money at a higher rate to make a profit. However, you can only invest in a term deposit at a Bank or Credit Union whereas we are Fund Managers and non-bank lenders, so when you invest in a Mortgage Fund you buy units in the fund, in our case $1 for 1 unit.

A term deposit is a cash investment held at a bank or a credit union. Your cash is invested for an agreed period of time (the term), at a pre-determined rate of interest. When you deposit your money, you know it is there for a specific period which usually ranges from 1 month to 5 years. The interest rate is fixed and will not change for that period of time. The money can only be withdrawn at the end of the term without penalty. If you withdraw earlier, you will incur an extra fee.

Bank term deposits are covered by the Federal Government’s Deposit Guarantee up to $250,000 per account holder per ADI. They are popular with investors who prefer the safety of a bank, instead of the volatility of shares or property. Many investors also use term deposits as one part of a diversified portfolio, along with shares, managed funds, and property.

A Mortgage Fund, on the other hand, is a type of investment fund where investors’ money is lent (secured by a mortgage) to a range of borrowers who use the money to buy property, other investments or obtain cash out for business purposes. In return the fund manager pays investors regular distributions from the interest earned on the loans, ASCF can do this because we charge our borrowers around 10% pa to 14% pa, from which we pay our investors between 5.6% pa and 7.5% pa after all fees, charges and expenses are deducted. In the case of ASCF our funds are pooled funds where the risk is spread across many loans with many other investors.

Traditionally term deposits are at a lower interest rate, typically 3.5% pa to 5.0% pa in the current market, whereas mortgage fund targeted returns are much higher, our targeted returns start at 5.6% pa and you can earn a higher targeted return of 7.5% pa in our High Yield Fund if you invest for 12 months.

Banks and non-bank lenders, both lend money which is secured by a registered mortgage over Australian property, however we don’t lend money in remote or rural areas because they are a higher risk and we tend to stick to the major capital cities and larger regional areas. We also don’t do construction loans. Having a registered mortgage over a property does give the lender the right, in the case of a default to take possession of the security property, and sell it to recover the funds.

ASCF is a Non-Bank Lender and Investment Fund Manager, specialising in short-term mortgage loans, the vast majority of which are bridging loans, secured by a registered mortgage over residential and commercial property in Australian capital cities and major regional areas, which we source from over 5,000 mortgage brokers around Australia.

You will find this video provides a useful explanation of how Mortgage Funds operate.

Banks will also do construction and property development loans whereas we don’t because they are a higher risk, particularly in the current market.

Banks will lend up to 95% LVR whereas our lending ratios are much lower, up to a maximum of 80% in our High Yield Fund, however currently our average weighted LVR across all three funds is around 60%.

Banks are owned by shareholders or members whereas we are privately owned, smaller and more dynamic, banks larger and slower, thus our service levels are much faster and more responsive. We like to think of ourselves as disrupting the traditionally slow and stressful process of property finance. For example, we have the ability to settle a loan within 4 business days whereas banks can take 4 to 12 weeks to settle a loan. Many borrowers will come to us because of our speed of settlements.

We typically offer finance to borrowers who require a short-term bridging loan or where they are awaiting approval from another lender and need a fast, short-term solution to prevent a loss of deposit or other opportunity costs.

We also provide short term business purpose loans where the borrower/director has commercial or residential property to offer as security for the loan and needs a solution to assist with cash flow or business improvement.

All loans are secured by registered mortgages over Australian property.

Some lenders can take up weeks or longer to process and provide funds to a borrower. Our ability to provide the funds within 4 days, once the loan is approved means we can offer borrowers a niche solution.

We source enquiries for loans both via our internal brokers and by our membership to aggregator panels Finsure and AFG that have over 5,000 Brokers Australia wide.

Since commencement in 2016:

All investors have received their interest distribution every month

All investors have had their request to redeem funds paid in full

The value of investors initial investment has remained stable at $1.00 per unit

ASCF is one of Australia’s leading short-term private lenders and our directors have over 70 years combined experience in banking, finance and property.

I hope the information above is helpful to explain the differences between a bank term deposit and an investment in a mortgage fund and the difference between a bank and a non-bank lender.

An Interesting Transaction

Problem:

A husband and wife contacted us directly after receiving a recommendation from a friend.

This couple were severely affected financially by COVID and have found themselves on the back foot ever since with regard to their home loan and other personal debt commitments. Currently living in an inner Brisbane suburb, they decided to downsize and move to Toowoomba to semi-retire. This plan would leave them debt free.

They approached ASCF seeking a Sale Funding Loan to consolidate their debts and also provide an additional $50,000 to facelift the property before putting it on the market to maximise their sale price.

Solution:

ASCF offered a 1st mortgage loan for $430,000 at a 46.99% LVR for 6 months to align with the customer’s plans to renovate for 3 months and give them 3 months to sell the property. All fees, charges and interest were retained from loan proceeds at drawdown.

Once the renovations are complete, they will sell the property and purchase in Toowoomba.

What ASCF Does Differently:

Just another example of how ASCF helps our customers fulfil their dreams.

Customer Testimonial:

“Thank you so much for understanding our situation, and for all the assistance in refinancing our home loan, it has been life-changing and will enable us to move forward. You and your entire team have been extremely professional and a pleasure to deal with.”

Market Update

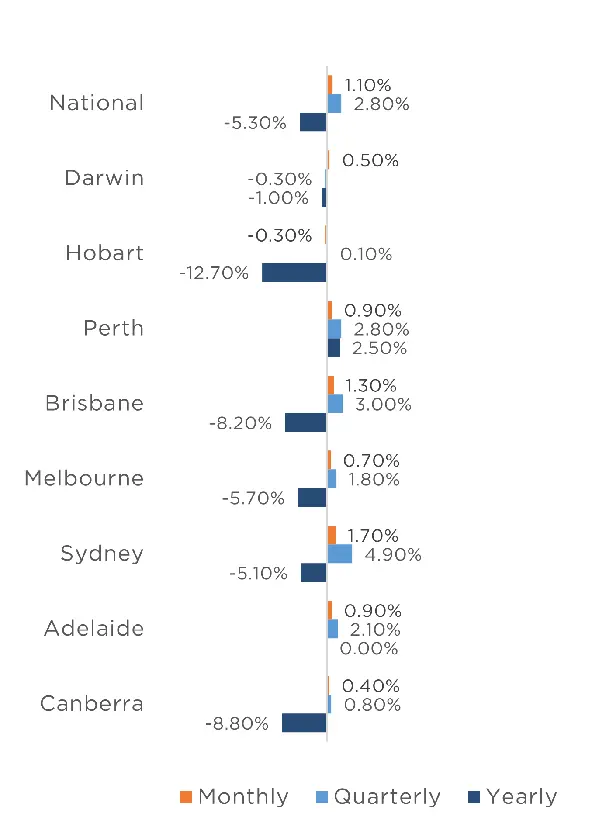

The Australian housing market finished the financial year strongly, increasing by 1.1% in June according to CoreLogic’s national Home Value index.

All capitals except for Hobart (-0.3%) recorded growth for the month, with Sydney the standout with a 1.7% monthly increase. Brisbane was not far behind (1.3%) followed by Adelaide (0.9%), Perth (0.9%), Melbourne (0.7%), Darwin (0.5%) and Canberra (0.4%).

The regions also performed strongly with only regional Victoria (-0.4%) and Tasmania (-0.3%) recording a reduction. Regional Queensland and South Australia performed best, with both recording a 1% increase. Regional New South Wales and Western Australia also saw a modest increase of 0.3%.

The particularly strong performance over the past two months resulted in very favorable quarterly results, with all markets except for Darwin and regional Victoria experiencing growth.

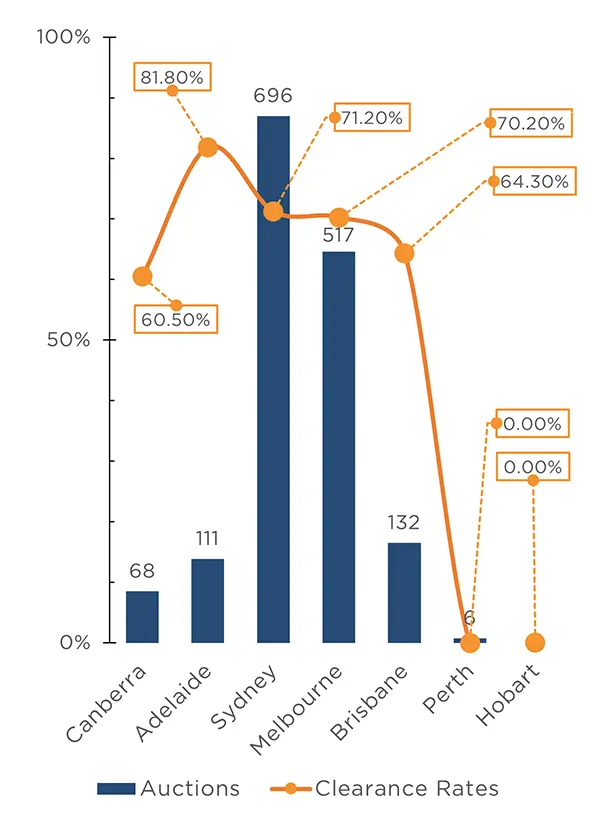

Auction numbers continue to be bellow that of last year, with 1,530 auctions taking place on the first weekend of July, down from 1,881 in the previous year. This further highlights the lack of supply in the housing market, with all capital cities recording fewer auctions than the same weekend of 2022.

Sydney recorded the most auctions with 696 taking place with Melbourne not far behind with 517. Brisbane, Adelaide, Canberra and Perth recorded significantly fewer auctions with 132, 111, 68 and 6 respectively. There were no auctions held in Tasmania, however there was also only 1 auction on the same weekend last year.

This lack of supply is resulting in higher than usual clearance rates, with the weighted average clearance rate of 70.3% for the weekend, up from 53.2% in the previous year. Once again, clearance rates are higher across all capital cities than last year, with Adelaide performing the strongest at 81.8% (up from 65.4% last year). Sydney (71.2%), Melbourne (70.2%), Brisbane (64.3%) and Canberra (60.5%) all performed strongly and well above previous years results of 49.9%, 55.8%, 45.2% and 52.9% respectively.

Clearance Rates & Auctions

26th June – 2nd of July 2023

Property Values

as at 30th of June 2023

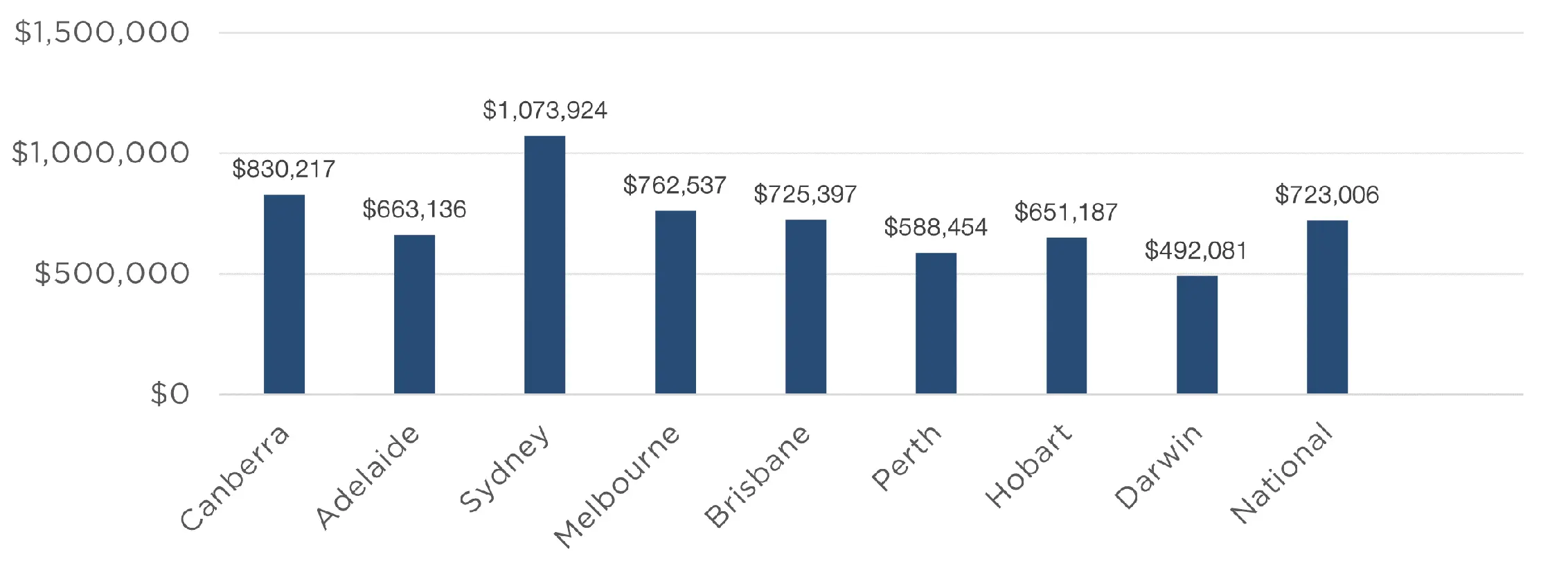

Median Dwelling Values

as at 30th of June 2023

Quick Insights

Crucial Approvals

In May, there was a significant increase in home lending and building approval figures.

Home lending grew by 4.8%, reaching $24.9 billion, while loans for established dwellings rose by 4.2%, reflecting the growth of house prices. Sydney house prices have recovered by 6.7% since January, with a slight slowdown in June (1.7% growth compared to 1.8% in May).

Analysts originally cautioned that while there are strong gains in lending and building approvals, further rate increases may impede the housing market recovery, the recent RBA decision may have winnowed these concerns.

Source: Australian Financial Review

Rebounds & Returns

Sydney house prices have rebounded by 6.7 per cent since bottoming out in January, as low stock levels continue to collide with solid demand, CoreLogic’s June home value index shows.

A lack of supply and strong population growth continue to put upward pressure on home values despite higher interest rates.

Housing values nationwide increased by 1.1 per cent in June, marking the fourth consecutive month of recovery, although it was a slight slowdown from the 1.2 per cent growth in the previous month.

Source: Australian Financial Review

The post Investor’s Update – June 2023 appeared first on Australian Secure Capital Fund.