Trading Update

Last months RBA minutes on its decision to leave rates on hold clearly indicate the RBA has adopted a neutral bias in relation to interest rates.

The annual rate of inflation for February remained steady at 3.4% although 0.1% lower than expectations however the unexpected decline in the monthly unemployment rate to 3.7% in February from 4.1% in January shows the labour market may no longer be softening.

ASCF Current Targeted Distribution Rates

ASCF High Yield Fund

| 3 Months | 6 Months | 12 Months | 24 Months |

|---|---|---|---|

| 6.50% | 7.25% | 7.75% | 7.30% |

ASCF Select Income Fund

| 3 Months | 6 Months | 12 Months | 24 Months |

|---|---|---|---|

| 6.25% | 6.75% | 7.25% | 6.75% |

ASCF Premium Capital Fund

| 6 Months | 12 Months | 18 Months | 24 Months |

|---|---|---|---|

| 6.10% | 6.25% | 6.75% | 6.30% |

ASCF Private Fund

| 3 Months | 6 Months | 12 Months | 24 Months |

|---|---|---|---|

| 8.19% | 8.39% | 8.59% | 8.49% |

This was further confirmed by the release of March’s employment data earlier today which came in at 3.8% which was only 0.1% higher than the prior month.

With real GDP growth expanding by a tepid 0.2% in the December quarter February’s lower unemployment rate was certainly a surprise to most economists suggesting there is a disconnect between an economy barely growing and labour market data showing its still running hot.

As a result there remains diverging opinions in relation to how quickly the RBA starts cutting rates, and the recent inflation data print in the US which came in higher than expected has led some to ponder whether we will see an interest rate cut this year at all, suggesting that inflation could be stickier than previously thought.

The Stage 3 tax cuts due to come into force on July 1 will certainly assist with cost of living pressures but the question remains as to whether it will also add pressure to inflation should consumers decide to spend rather than save the additional income.

On balance we believe one should take confidence in the lower GDP number over the unemployment data and our expectation remains that inflation will continue to decline albeit somewhat slower than previously thought allowing the RBA to cut rates later this year.

Property prices continued to rise in March with residential property up nationally by 0.6% in March, matching February’s gain.

Half-Yearly Financials Now Online

Our half-yearly audited financial statements for each of our retail funds for the period ending 31 December 2023 are now available for viewing on our website or by clicking here. Should you have any questions, do not hesitate to contact our Investor Relations

team on 1300 269 419.

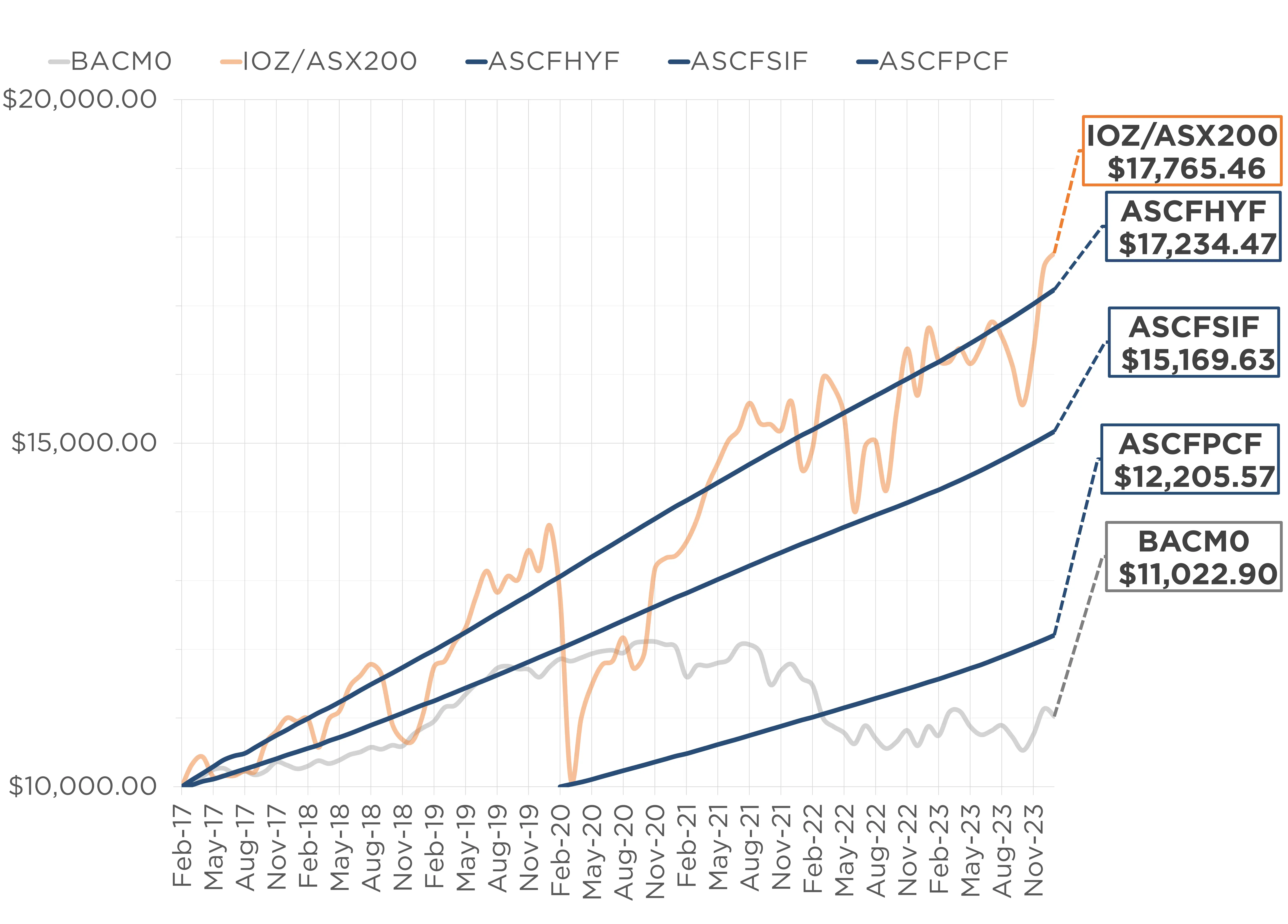

Monthly Managed Fund Cumulative Growth & Performance

Note 2: Past performance is not indicative of future performance

Managed Funds Under Management

as at 31st of March 2024

| March 2024 | |

|---|---|

| ASCF High Yield Fund | $139,923,343.97 |

| ASCF Select Income Fund | $44,792,692.73 |

| ASCF Premium Capital Fund | $23,489,870.02 |

| Combined Funds under Management | $208,205,906.72 |

In March, loan originations and inquiry levels remained solid, with $20,856,000 in new loan originations settled.

The unit price across all three of our retail funds remains stable at $1.00 per unit.

All monthly distributions have been paid in full for the month of March.

Lending Activity Update

Quarterly Loan Settlements

as at 31st of March 2024

Current Loans by Fund Source

as at 31st of March 2024

| High Yield Fund | Select Income Fund | Premium Capital Fund | |

|---|---|---|---|

| 1st Mortgage Loans | 79.99% | 100% | 100% |

| 2nd Mortgage Loans | 15.79% | 0% | 0% |

| 1st & 2nd Mortgage Loans | 4.22% | 0% | 0% |

| Avg. Weighted LVR | 55.97% | 53.25% | 47.27% |

| Avg. Loan Size | $1,352,262.43 | $1,054,660.33 | $810,822.02 |

Current Loans Geography

as at 31st of March 2024

Why Invest with ASCF?

Property investment has always been a significant contributor to building wealth in Australia. However, not all investors are able to secure a direct investment in property or perhaps want to manage the issues that arise when dealing with tenants and the ongoing burden of the statutory charges associated with owning a property including payment of rates, land taxes and water levies.

Most non-owner occupier residential property investments in Australia are negatively geared which means they are cash flow negative once the monthly mortgage payment and all statutory expenses associated with holding the property are paid.

This is typically a cash drain on other sources of income and while there may be capital appreciation this is usually not able to be crystallised until the property is sold.

ASCF’s pooled mortgage funds offer an alternative to direct property investments. They offer investors the opportunity to invest in the property market without having to purchase and manage properties themselves.

The funds invest in mortgages over Australian property and offer a targeted distribution return to investors of between 6.1% and 7.75% p.a depending on the fund selected and the investment term.

This makes them an attractive option for those who want to diversify their portfolio and gain indirect exposure to the property market.

In addition, our pooled mortgage funds offer regular income payments in the form of targeted monthly distribution payments, particularly for investors who are seeking an income stream.

Most economists are now expecting the RBA to reduce rates by between 0.25% and 0.75% over the next 12 months so if you are seeking an inflation responsive return that offers a monthly distribution, consider our funds as part of your investment strategy.

An Interesting Transaction

Problem:

A lending scenario was presented to us by one of our valued brokers whereby a customer required $340,000 for 6 months for his security consultancy business to allow him to complete new contracts.

Solution:

The customer was prepared to provide a 2nd mortgage over his principal place of residence to secure the loan resulting in a LVR (including the confirmed 1st mortgage) of 68.12%. ASCF provided a 6 month term loan at an annual interest rate 19.80% after receiving a full valuation from one of our panel valuers.

The loan will be repaid in full once payments for those completed contracts are received from his customers.

What ASCF Does Differently:

Our speed to market was paramount to winning this transaction as the customer required expedient access to capital to engage his suppliers and ensure he had sufficent resources to complete the new contracts. Another reason why customers continue to turn to ASCF to meet their short term funding needs.

Market Update

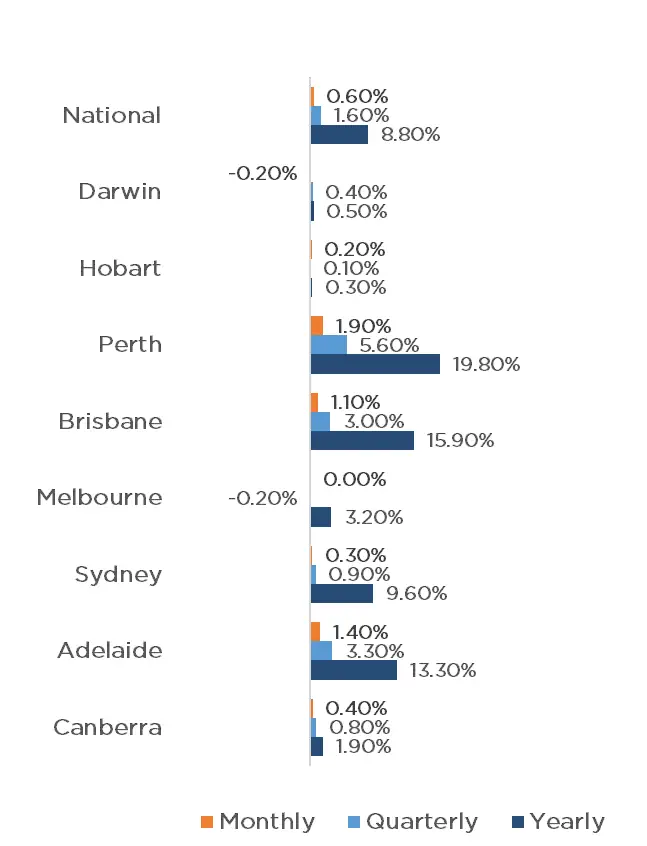

Property values continue to increase across the majority of the country, with CoreLogic’s National Home Value Index recording a further 0.6% increase in March, on par with what was achieved in February, resulting in 14 months of continuous monthly growth. Perth continued to be the strongest performer, increasing by a mammoth 1.9% for the month, followed closely by Adelaide with 1.4% and Brisbane with 1.1%. Signs of cooling have begun in Canberra, Sydney and Hobart, with 0.4%, 0.3% and 0.2% growth respectively. Melbourne achieved parity for the month, whilst Darwin is the only capital to experience a loss, falling by 0.2%. This monthly data contributes to a 1.6% national increase for the quarter, with all capital cities experiencing some level of quarterly growth except for Melbourne, where a 0.2% reduction has occurred.

As we wait for the next RBA meeting, scheduled for the 7th of May, there are growing calls by economists for a rate reduction to occur, driven by the continued slowing of GDP growth and falling inflation. Whether or not a reduction is made in May, it appears all but certain that throughout 2024 there will be reductions, which will likely result in a further bump to property prices in the coming months.

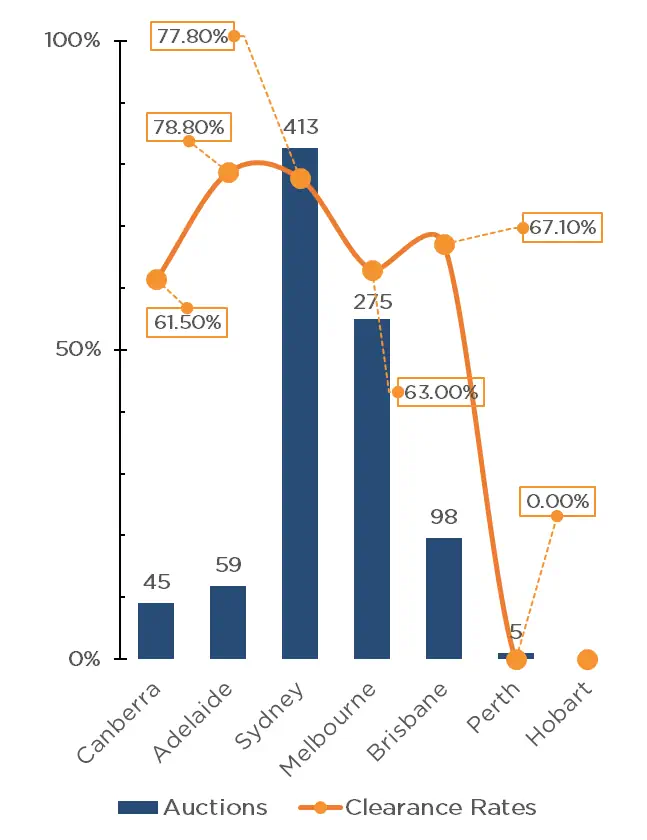

Clearance Rates & Auctions

week of 2nd of April 2024

Property Values

as at 31st of March 2024

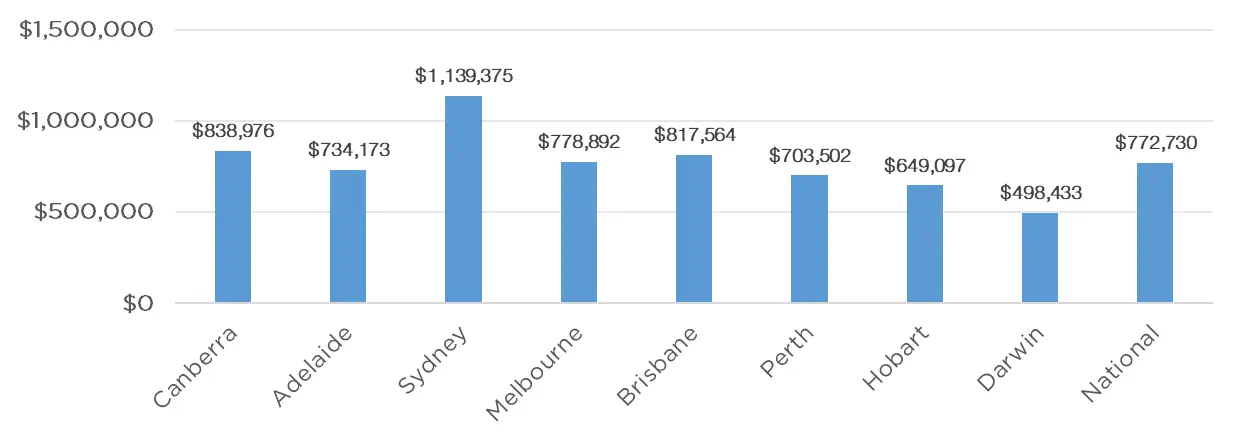

Median Dwelling Values

as at 31st of March 2024

Quick Insights

Steadfast Forecast

Oxford Economics Australia, a leading economic institute has forecasted median property to grow to almost $2 million in Sydney alone within the next 3 years.

“You have a fundamentally undersupplied market and with net overseas migration running at half a million people, a growing participation by foreign buyers, downsizers and cash buyers, demand has outweighed that drag that interest rates would typically have.”, said Maree Kilroy, Oxford Economics senior economist.

Source: Australian Financial Review

Affordability is the Trend

The medium-high end of the Sydney housing market may have finally reached a peak that lower end buyers cannot afford as a flood of homebuyers move into previously affordable suburbs driving prices up.

The lower end market has grown 5 times as fast as the higher end in past 6 months, and is likely to continue as more people seek to delay the effect of the housing crisis in their lives.

Source: Australian Financial Review

The post Investor’s Update – March 2024 appeared first on Australian Secure Capital Fund.